financial analysis framework

cfa | financial analysis

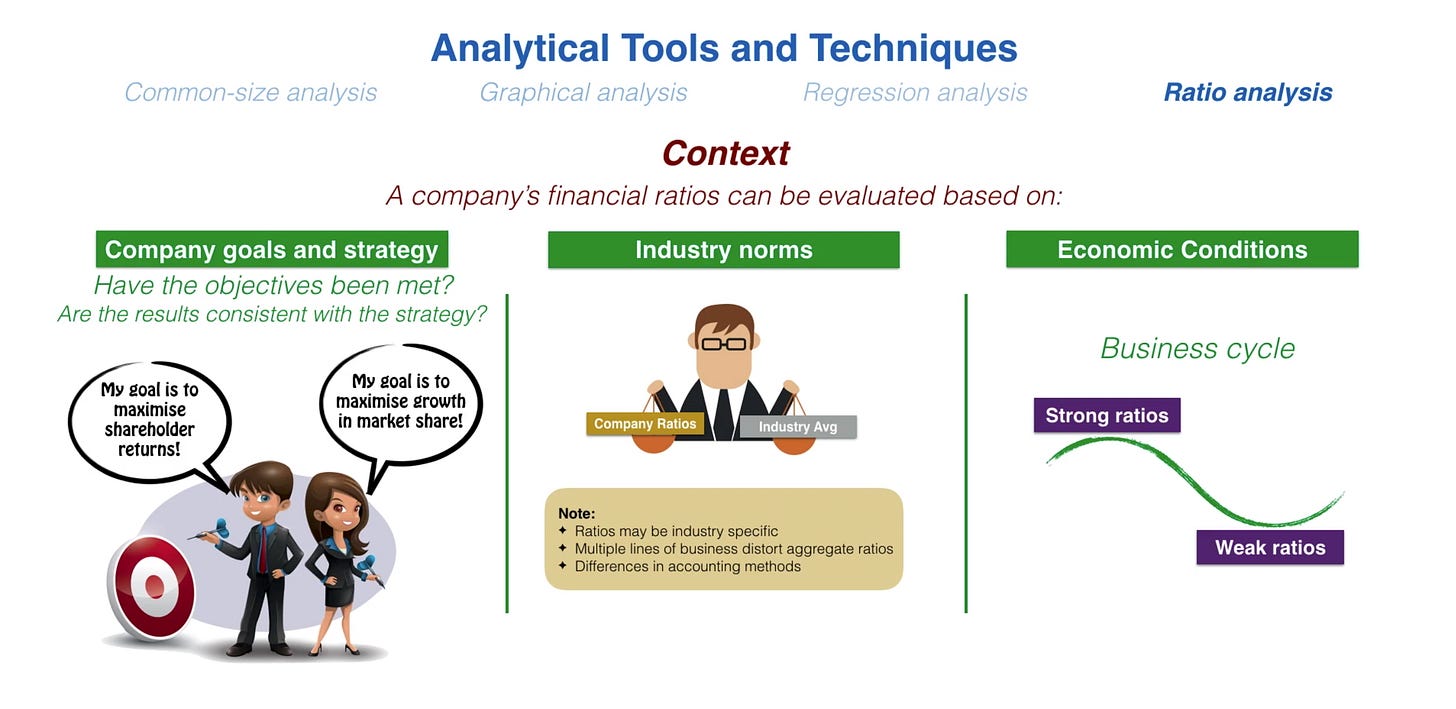

the numbers and ratios need to be put into

context.

single ratios can not tell a story.

we can also judge it based on the goals and strategies of the company: steady growth or aggressive growth, to maximize profits for shareholders or expand in a market

we can look at a company over a period or compare it with other partners in the same industry.

How to read P/E and P/B ratio?

A company with a high P/B ratio could mean the stock price is overvalued, while a company with a lower P/B (less than one) could be undervalued.

If a company has a high P/B (for example 2.0), it means the stocks are 2 higher than its book value > > it’s overvalued by public.

For example, if a company has a price-to-book value of three, it means that its stock is trading at three times its book value. As a result, the stock price could be overvalued relative to its assets.

ROE

P/B provides a valuable reality check for investors seeking growth at a reasonable price. P/B is often looked at in conjunction with return on equity (ROE), a reliable growth indicator. ROE represents a company's profit or net income as compared to shareholders' equity, which is assets minus debt. ROE is important because it shows how much profit is being generated with the company's assets.

Large discrepancies between P/B and ROE are often a red flag. Overvalued growth stocks can have a combination of low ROE and high P/B ratios. If a company's ROE is growing, its P/B ratio should be doing the same.

example of P/B

Let's say that a company has the following information:

Assets = $100 million

Liabilities = $75 million

Outstanding shares = 10 million

Stock price = $5 per share

We first calculate the company's book value and book value per share.

Book value = $25 million ($100 million assets - $75 million liabilities)

The book value per share = $2.50 ($25 million book value / 10 million shares)

P/B ratio = 2 ($5 stock price / $2.50 book-value-per share).

In other words, the stock is trading at two times its book value. Whether the valuation is justified depends on how the P/B ratio compares to its value in years past and the ratio of other companies within the same industry.

P/E ratio

Không dựa vào gía cổ phiếu để nói đắt hay rẻ mà cần so sánh P/E (với mỗi 1$ lời bạn phải bỏ ra bao nhiêu tiền đầu tư)

A higher P/E ratio means you are paying more to purchase a share of the company’s earnings.

P/E cao còn có nghĩa là các nhà đầu tư đang kỳ vọng sinh lợi nhiều từ cổ phiếu này. Bởi vì mọi người mong đợi nhiều nên cũng sẵn lòng trả nhiều tiền hơn.

P/E reflects investor expectation

Earnings are how a company is doing. The P/E ratio is how the company is expected to do.

ROE

The stock price reflects your return based on what the market thinks about the value of the company, while the return on equity actually measures the performance of the company directly.

If a company’s stock price tumbles but its ROE stays constant or even grows – it can potentially be a sign the company is undervalued.

A high return on equity (20%+), generated consistently for many years – is often the sign of an exceptional company run by a great manager, operating a great business with an economic moat.

Read this article:

https://www.wallstreetzen.com/blog/what-is-a-good-roe/