Operating return on asset (operating ROA)

cfa | financial analysis techniques

Operating ROA measures the income expected to be generated out of each dollar invested in its operating asset.

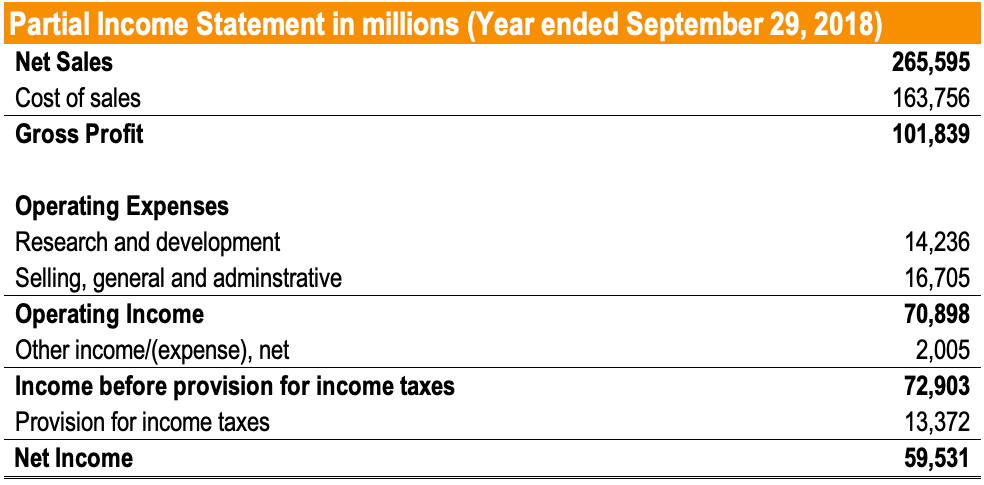

Operating ROA = EBIT earning before interest and tax/ Total assets

Before interest and tax: only count Cost of selling, admin and Cost of goods sold. These are recurring expenses, so it would be forecastable.

read this: https://corporatefinanceinstitute.com/resources/knowledge/finance/operating-return-on-assets-oroa/

Apple is forcasted to generate 0.19$ income per each dollar invested in its core operating assets.